Is generating cash flows through short-term rentals one of your goals? In this post we show you how to analyze a short-term rental (STR) deal and how to calculate useful financial metrics.

Here’s the link to our STR Calculator

Table of Contents

Introduction

The most common question we get from STR investors is “what are the numbers?”. Analyzing long-term rentals is easy since the monthly income is the same, and the tenant pays most of the expenses . On the other hand, STR have multiple expenses that change every month. Additionally, the revenues can be seasonal and fluctuate significantly each month.

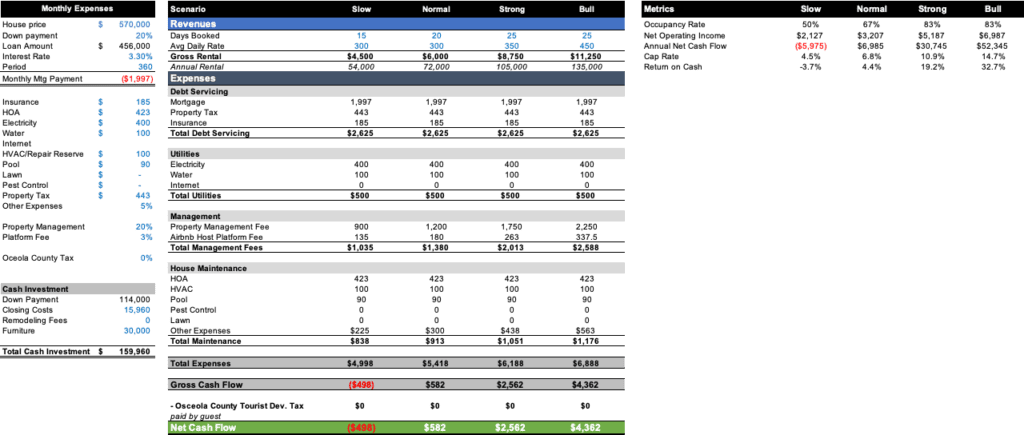

Hence, in order to make the analysis simple we’ll break down the analysis into three sections: revenue, expenses, and metrics. Finally, we’ll split the analysis into four scenarios: slow, normal, strong, and bull. The slow scenario will be our worst case scenario. Those will be the numbers we could expect during the weakest months. In contrast, the bull scenario will be the highest expected daily rates, typically during the holidays.

Revenues

The revenues are the booking rates multiplied by the number of days booked. Unfortunately, there is no easy way of calculating the expected booking rate. While there are a few providers of STR data, we’ve found the best way of knowing what you can expect is by researching similar properties in the neighborhood(s) you are planning on buying. You can do this by researching on Airbnb and VRBO for example.

A few things you should look for and compare are the following:

- Rates during weekdays and weekends

- Average rates for short stays (2-7 days) and long stays (14-30 days)

- Rates charged during holidays and events

- What is unique/WOW of the properties that can demand higher rates (lake view, themed rooms, pets allowed, etc)

Altogether, try to come up with the range you could charge on average.

Expenses

Mortgage Payment

One of the benefits of real estate is the ability to acquire an asset with debt. As long as you can generate a return higher than the cost of debt, the investment will generate a positive return. You can estimate the mortgage payment through a mortgage calculator online or by speaking with your lender.

Property Tax

Through the county’s appraiser website, you will be able to see the property’s historical tax. Some websites like Zillow also include this information.

Insurance

The insurance cost will vary significantly based on the property’s location, age, conditions, and other factors. Insurance for short-term rentals is more expensive than for long-term rentals or primary residences. Not only that, but not all insurance providers cover short-term rentals. Make sure to speak with your insurance agent and compare quotes as they can vary significantly.

Utilities

The utility costs include electricity, water, and cable/internet. Depending on the property you buy, the association (HOA) may cover cable/internet. All things considered, the electricity cost will vary and is usually the highest during the summer months while the cost of water tends to be stable.

Property Management

If you are planning on self-managing your property, you can ignore this expense. On the other hand, if you’ll be giving full control of your property to a management company, then this expense may be one of your highest. We’ve found that most full-service property managers charge around 20% of gross booking revenues.

Host Platform Fee

When you advertise your STR on Airbnb or VRBO you’ll have to pay their host platform fees. The fees are usually between 3-6% of the gross booking revenue.

House Maintenance

The following are the typical expenses in this category:

- Homeowners Association Fee (HOA) – some associations provide benefits like cable/internet, lawn maintenance, pest control, amenities, and others in their monthly or quarterly fees.

- Heating, Ventilation and Air Conditioning (HVAC) – in Florida most (if not all) modern houses have at least one HVAC unit. The units should be served every six months to ensure they operate properly. The cost will vary, but will be around $75-100 per visit.

- Pool – the pool will be one of the most important amenities in your STR in Florida. But it needs to be serviced on a weekly basis. The typical cost is around $20-30 per weekly visit.

- Pest Control – the last thing your guests want to see are bugs inside the house. Not to mention finding a wasp nest next to the entrance door. Therefore, having a good pest control company service your property every 2-3 months can be crucial. Similarly, the cost will vary but you can expect it to be around $70-90 per visit.

- Lawn – HOAs want to make sure that the neighborhood looks good and clean and will include lawn maintenance in their recurring fees. If your association doesn’t include it, then make sure to budget around $80-$100 a month for lawn maintenance.

- Other Expenses – this category includes repairs, upgrades, and other one-off expenses. It is safe to assume that you’ll have to repair at least one appliance every year, replace some furniture, and replace a few items. The small cleaning profit will cover some of these expenses. Unfortunately, there is no magic formula for this number, but we use 5% of gross booking revenues as an estimate.

County and State Taxes

Hosting platforms give you the option to have guests pay for the taxes and send them automatically to the authorities. You should confirm which taxes are handled by the platforms as not all of the taxes will be remitted by them.

Cleaning and Supply

Guest pay a cleaning fee for their stay. You should plan to charge the fee higher than what you’d pay to your cleaner so that it can be used to cover the supplies (e.g., replacing damaged towels/linens). In most cases, this results in a small profit which we tend to simply exclude in our cashflow models.

Metrics

Occupancy Rate

How many days each month is your property booked on average? The occupancy rate is the percentage of days your property is booked. We’ve averaged 85% over the past few years, but this number will vary by season, location, and daily rate.

Net Operating Income (NOI)

There are two ways to increase your net income, either increase revenues or decrease expenses. The NOI is the gross booking revenue minus operating expenses (exclude debt service/mortgage).

Cap Rate

The capitalization rate is the NOI over the value of the property. It’s a common metric used in real estate to compare the performance of multiple properties.

Annual Net Cash Flow

Most investors like to see how much money they can expect over the course of a year. The annual net cash flow is simply the monthly net income times 12.

Cash on Cash Return

Another metric widely used by investors in the cash on cash return. You can calculate the cash on cash return by dividing the annual net cash flow over the amount of money invested.

Conclusion

Short-term rentals can help an investors generate a higher level of income than long-term rentals. At the same time, understanding your expected revenues, expenses, and financial metrics is of high importance during the due diligence process. The model shown here while simple, covers all the common items and metrics that are calculated when analyzing various types of short-term rentals.

Below is our complete model for your reference, including actual numbers used during the due diligence of a property. As always, if you have any questions feel free to reach out through our contact form!