Should I Buy a Resort or a Non-Resort Short-Term Rental

Short-term rentals in Orlando/Kissimmee are located in either a resort or a non-resort style community. The type of community you choose is one of the biggest factors at the time of purchase.

Introduction

Resort-style communities are neighborhoods managed by an association with multiple amenities. The goal of the association is to ensure the community is managed similarly to a resort.

On the other hand, a non-resort community is your typical residential neighborhood.

With that being said, what are the advantages and disadvantages of each type of community? Let’s take a look.

Resort Style

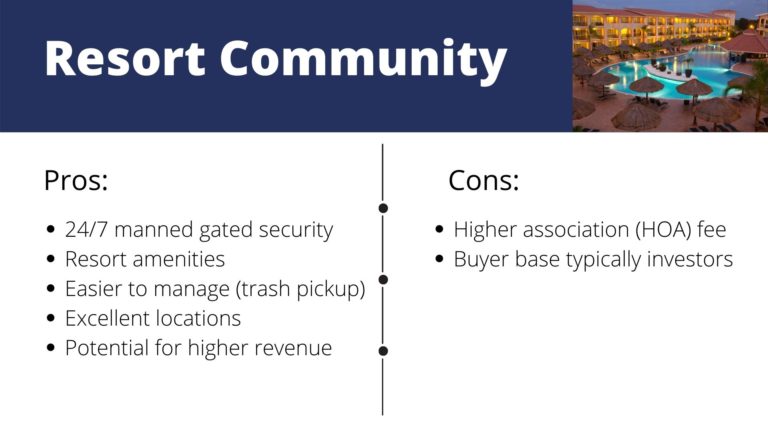

When you own a resort-style property, it belongs in an association. The goal of the association is to ensure the community is managed similarly to a resort. Likewise, it will have multiple amenities like pools, entertainment centers, gym, tennis courts, and others. To enjoy those benefits you pay a monthly or quarterly association fee. While the fee may seem high, it usually includes access to the amenities, landscaping, and sometimes basic cable/Internet. Another benefit is that the association takes care of the trash pickup which makes it easier to manage and is convenient for guests. Furthermore, resort-style communities tend to be in prime locations, which can help generate higher booking rates.

Finally, these properties are owned majorly by investors. During good times that could be an advantage, but in recession periods when no one is traveling they can depreciate quickly and become hard to sell.

Non-Resort Communities

Non-resort community rentals are properties located in residential neighborhoods where the majority homeowners are primary residents. They are usually located in quiet neighborhoods and scattered all over the city. Typically, a non-resort property will be less expensive per square feet and have low or no association fees. Hence, they make it ideal for someone starting in the short-term rental business to enter the business at a low cost. Similarly, they can be easy to sell or flip as both investors and residents are part of your buyer base.

As short-term rentals, they will typically commend lower booking rates since they have no extra amenities. Additionally, some neighbors in residential communities do not like to have short-term rentals next to them, hence conflict is a risk. One important thing to note is not all professional property managers will manage STR in non-resort communities. If you plan to buy your STR it’s important to identify your property manager before you make your purchase. Finally, you should do your due diligence regarding the zoning, county STR rules & regulations and HOA rules if applicable for the area/community.