Is generating passive income through long-term rentals one of your goals? In this post we show you how to analyze a long-term rental deal and show you how to calculate some of the more useful financial metrics.

Introduction

One of my goals as a real estate investor is to genera passive income. While there are a few strategies and investments that can allow you to achieve this goal, my favorite one is through long-term rentals.

There are multiple types of properties that can be used as long-term rentals, but properties in condominiums are the ones that requires the least amount of maintenance.

A condominium, or “condo” for short, is a privately owned individual unit within a building of other units. Condo owners jointly own shared common areas and amenities which are administered by an association. When you own a condo, you are responsible for the interior of the property, but the Home Owner’s Association (“HOA” for short) takes care of the exterior.

One benefit of condos is that they require very low maintenance at a cost usually comparable to a house. Another benefit is the security of living in a closed community. Finally, condos tend to cost less than apartments and single-family homes as they tend to be more compact.

This post will use a condo as an example, but the same metrics and analysis apply to other types of long-term rentals.

How to analyze a long-term rental?

The analysis of a long-term rental deal can be split into three segments: revenues, expenses, and financial metrics.

Revenue

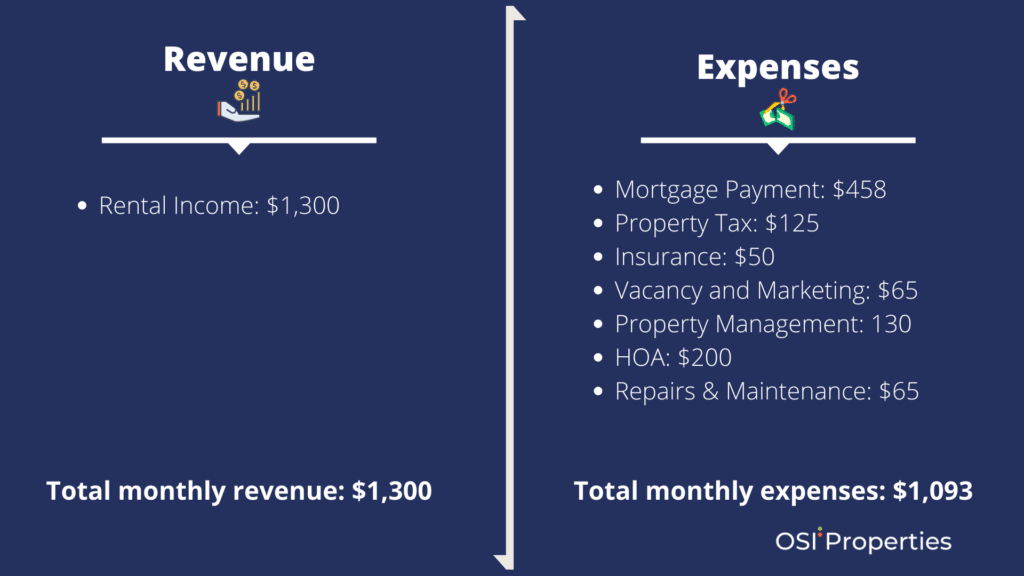

The source of revenue in a long-term rental is the monthly rent charged to your tenant. It is important to have a good estimate of how much rent you can charge. One of the best ways to know the market rate for the property is by looking at comparable properties in the area through Zillow or similar websites. Specifically, compare similar properties based on number of bedrooms, size, conditions of the property, and amenities. For this example, let’s assume the market rent is $1,300 a month based on comparable properties in the area.

Expenses

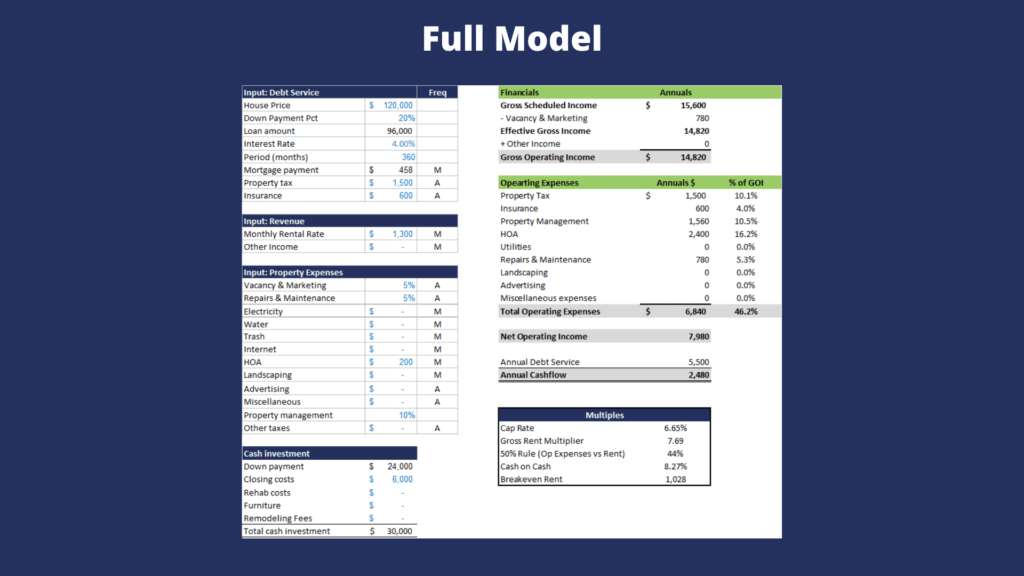

Mortgage Payment

One of the benefits of real estate that we’ve highlighted in a previous post is the ability to acquire an asset with debt. As long as you can generate a return higher than the cost of debt, the investment will generate a positive return. You can estimate the mortgage payment through a mortgage calculator online or by speaking with your lender. If the property price is $120,000 and you put 20% as a down payment at a 4% interest rate, the monthly mortgage payment will be $458.

Property Tax

Through the county’s appraiser website, you will be able to see the property’s historical tax. Some websites like Zillow also include this information. For our example we’ll assume the expected property tax will be $1,500, which is $125 a month.

Insurance

The insurance cost will vary significantly based on the property’s location, age, conditions, and other factors. With that being said, another benefit of properties in condos is that the insurance cost tends to be very low. Hence, we’ll be using an annual insurance premium of $600, or $50 a month which is typical for condos in Central Florida.

Vacancy and Marketing

Vacancy and marketing costs are usually split when analyzing long-term rental deals, but I prefer to combine them as they both represent the cost of having the property vacant. Vacancy cost is a non-cash expense, but it is prudent to include an expected vacancy when analyzing long-term rentals. The reason is that vacancy can be one of the largest expenses you could incur in some years when a tenant doesn’t renew the lease. Consequently, when I do my analysis, I use 5% ($65 a month) as vacancy and marketing cost.

Marketing includes the cost of promoting your property. Zillow charges anywhere between $5 and $10 a week for posting rentals in some areas.

Property Management

In general, property managers charge two fees: leasing and the property management fee. The leasing fee is the cost of finding a new tenant for your property, while the management fee is the monthly ongoing charge. Leasing fees are either a percentage of one month of rent (~50%) or a flat fee. On the other hand, the ongoing property management charge is typically 10% of the rent. Thus, we’ll be using 10% for our example ($130)

HOA

Every condo has a monthly homeowners association fee. What’s included varies greatly by the association, but typically includes the maintenance of the exterior as well as the amenities. Some associations also cover the cost of some of the utilities, such as water and internet. For our example we’ll use $200 a month.

Repairs and Maintenance

While it’s hard to estimate how much you could spend in repairs and maintenance, I always budget for at least half a month. Some properties go years without having to repair anything and then one year the washer, dryer, and HVAC break down. Indeed, some landlords prefer to have home warranties in their properties to avoid surprise expenses and to help accurately budget their cashflows. For this reason, we have warranties in some of our older houses. But for the newer ones we budget 5% a year which is approximately $65 a month.

Metrics

With all the revenue and expenses data, it’s time to calculate some financial metrics to determine the expected performance of the property.

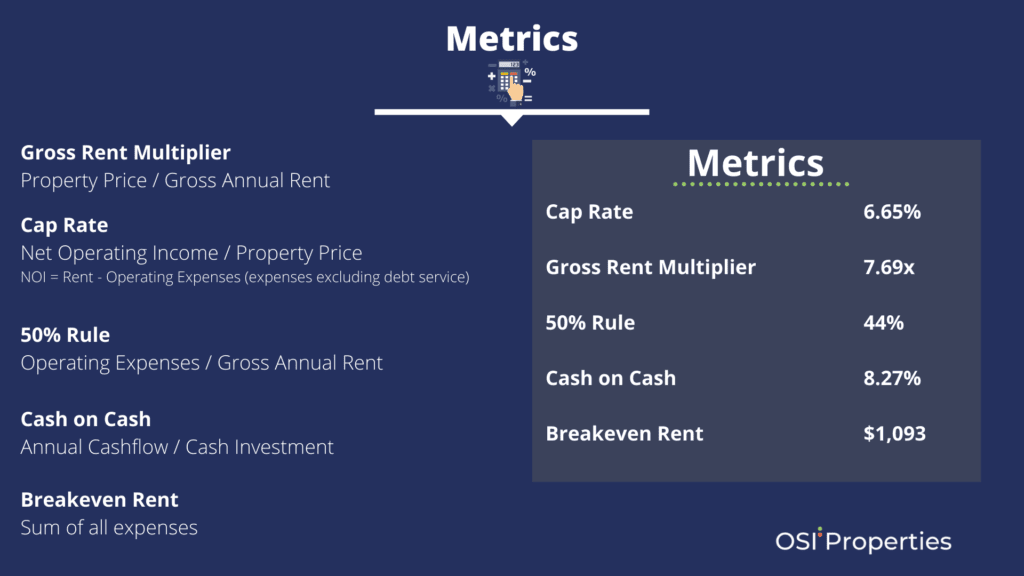

Gross Rent Multiplier

Probably the easiest one to calculate, it is the property price divided by the annual gross rental income. It tells you the number of years the property would take to pay for itself.

In our example it would take 7.69 years for the rent to cover the property price.

7.69 = $120,000 / ($1,300 x 12)

Another variant to this ratio is the monthly rent divided by the property price ($1,300 / $120,000 = 1.1%). As a rule of thumb, the rent should equal approximately 1% of the property price. Some people use the 2% rule, but it’s extremely difficult to find properties where the monthly rent equals 2% of the property price.

Cap Rate

One of the most used metrics in real estate, the capitalization rate tells you the expected rate of return of your property. It is calculated by dividing the annual net operating income by the purchase price.

Operating income equals rent minus expenses before debt service (mortgage interest and principal).

The expected cap rate of our example is 6.65%. A cap rate is useful as a valuation tool and makes it easier to compare different types of real estate investments.

50% Rule

A variant of the cap rate, but for calculating expenses is the 50% rule. To calculate the 50% rule, you take the annual operating expenses divided by the annual gross rental income. The idea is that operating expenses should be around 50% or less. For our example the 50% rule ratio is 44%.

Cash on Cash

Another important metric, it is calculated by dividing the annual cashflow by the cash invested. In our example let’s assume that the closing costs were $6,000. Total cash investment in this case would be the down payment plus the closing costs. $30,000. To simplify the example lets assume no rehab costs or any additional cash investment.

Annual cashflow: $2,480

Cash Investment: $30,000

Cash on cash return: 8.3%

Breakeven rent

Finally, the breakeven rent tells you how much rent you have to charge every month to cover all your costs. In our example, the monthly costs are $1,093

Conclusion

Long-term rentals can help an investor generate passive cashflow through monthly rental payments. If the investor is seeking very low maintenance compared to a traditional house, a property in a condominium can help provide stable cashflows. At the same time, understanding your expected revenues, expenses, and financial metrics is of high importance during the due diligence process. The model shown here while simple, covers all the common items and metrics that are calculated when analyzing various types of long-term rentals.

Below is the complete model for your reference. As always, if you have any questions feel free to reach out through our contact form!