While most people have been avoiding short term rentals during the COVID pandemic, we believe that they present one of the best investment opportunities in real estate now. In this post we share our research and views into why now is the time to take advantage of this opportunity.

Introduction

In this article we want to cover two topics about short term rentals: (1) should you invest in short term rentals during COVID-19 and (2) how to successfully invest in them.

Should I invest in short term rentals during COVID-19?

The short answer is yes, for two reasons:

- Travelers will prefer the privacy of a single family short term rental over hotels

- Real estate investments should do well in the coming years

Travelers will prefer the privacy of a single family short term rental over hotels

If you own a short term rental in a building or community dedicated to vacation rentals, then you may have a harder time renting your property. On the other hand, if you own a single family home with a private pool, you will likely attract more guests. What makes a single family short term rental stand out from hotels and resorts is privacy. Given social distancing rules, people try to avoid being in a crowded area and sharing common spaces.

According to the NY Times and an ongoing survey of travelers by Destination Analysts, more than half of American travelers say they plan to avoid crowded destinations when they resume traveling. A similar trend can be seen already, with many national parks also seeing record number of visitors.

To address guest’s safety concerns, most hotels have announced new cleaning and distancing policies. An argument can be made that staying at a stranger’s house may be more dangerous than in a large chain hotel. But, for that reason, Airbnb has also taken steps with enhanced cleaning guidelines and their enhanced clean initiative.

In summary, single family short term rentals that offer contact-less check-in and check-out and adhere to the enhanced cleaning protocols will be a more attractive lodging option for concerned travelers.

Real estate investments should do very well

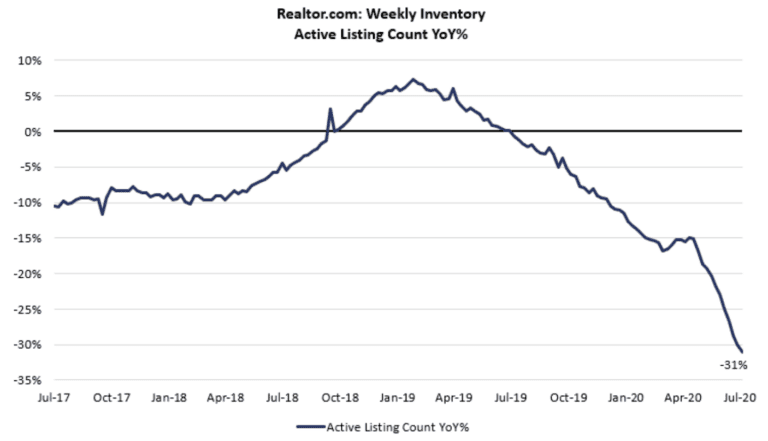

Let’s take a look at the inventory data. According to Realtor.com, inventories are down 31% compared to a year ago as of end of July 2020. The same story can be seen in almost every market, where investors are having a hard time finding properties, and listings have been selling at list price

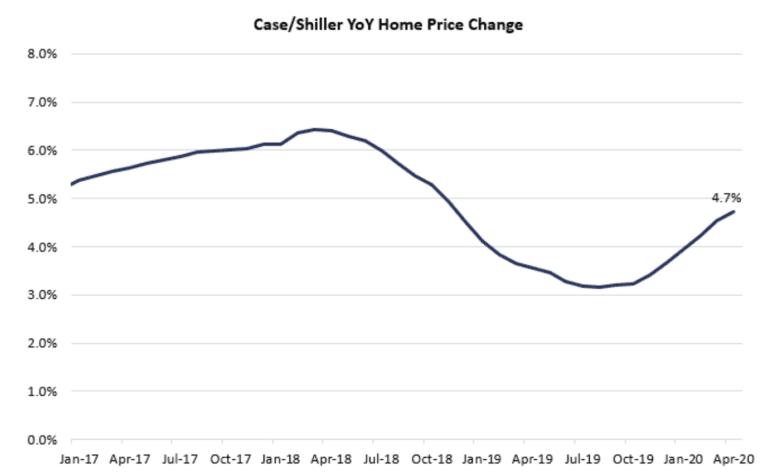

It all comes down to supply and demand dynamics. While inventories are declining, the demand remains strong. Hence, home prices continue to rise. And this trend should continue for a while.

We have low inventories and stable property price appreciation. But, we are still in the middle of a global pandemic. How can real estate do well in this environment?

- Huge amount of fiscal and monetary stimulus injected into the economy. In the US the Federal Reserve lowered interest rates to 0-0.25%. Secondly, Congress rolled out a $2.3 trillion package on April 9, 2020 to bolster the economy. In addition, the Federal Reserve is buying mortgages, Treasuries, and even corporate bonds.

- There are not enough assets in the world. With government bonds yielding close to zero (and negative in some European countries), it’s hard to find assets that can generate enough cash flows to meet retirement needs and pension obligations. In addition, we have an aging population in most of the developed world. For those reasons, the cash flow that real estate can generate (either from long-term or short-term rentals) looks very attractive. A similar trend can be seeing in private equity and investment funds being created to buy real estate.

How to successfully invest in short term rentals during COVID-19

We analyze short term rentals based on the following qualitative and quantitative factors.

Qualitative factors:

- Attractive location. The property should be located close to the beach/lake or popular attractions (Disney, Universal, etc.).

- Amenities. Private pool is a must, in addition to a BBQ and an updated kitchen.

- Cleanliness. This is non-negotiable. Short-term rentals in this environment need to be perfectly clean. A spot in a towel or a hair in the bathtub can be the difference between a 5-star review or a 3-star review.

- Privacy. People don’t want to share common spaces or amenities with strangers.

Quantitative factors:

- Low or no association fee. Keeping expenses to a minimum will allow you to have more flexibility during tough periods. Some vacation/resort neighborhoods tend to have very high monthly fees as they include many amenities, which guests may not take advantage of during the pandemic.

- Positive cash flow if converted to a long term rental. We are living in an unprecedented period, and having multiple options at hand can reduce some of that uncertainty. When analyzing the investment, make sure that you will be able to generate a positive cash flow if you convert the property to a long term rental.

Conclusion

Single family short-term rental homes located in attractive locations with privacy and good amenities should do well in this environment. Needless to say, this is not a popular view as the outlook for global travel and tourism looks grim. The pandemic is changing the way we live and interact with each other, and forcing businesses to change the way they interact with clients. In our view, this is opening up an opportunity as people change the way they travel and vacation. A well located single family short term rental with great property management should be well positioned to succeed in this new world.